Issue 05

Surgitech : The Science of Specialisation

Surgitech is a leading supplier of innovative speciality surgical devices throughout South Africa.

Drake & Scull : Best in FM

Facilities management is the cornerstone of operations of Drake & Scull, a Tsebo Outsourcing Group company with aspirations to conquer Africa. CEO John Wentzel tells us more about the challenges facing the FM industry.

DipCivils : Driving Operational Excellence

DipCivils (Pty) Ltd is a Civil Engineering contractor that specialises in the construction of roads and other services throughout South Africa. Procurement Manager Raymond Carter-Johnson tells us more.

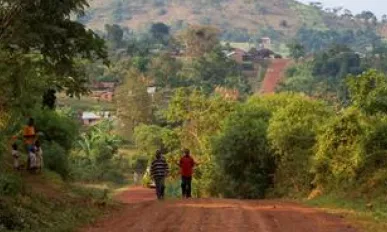

Kuku Foods Kenya : Embracing the Brand

Gavin J Bell, GM of Kuku Foods Kenya Limited, the KFC franchisee in Kenya, Uganda and Tanzania, tells us more about exciting expansion plans and how Kenyans have embraced the brand.

MLife : In It For Life

Africa Outlook talks to Agnes Chakonta, the Managing Director of Madison Life Insurance Company Zambia (MLife).

Oragroup : Continent of Dreams

Oragroup is expanding as demand for banking services in West and Central Africa grows. Ferdinand Kemoum Ngon, Managing Director of Emerging Capital Partners (ECP) and Deputy CEO of Oragroup, tells us more.

Ericsson Sub-Saharan Africa : Setting Sights on Africa

Globally, the telecoms industry has been facing rough trading conditions. However, with Ericsson, Africa seems to be growing from strength to strength.

Bannon Limited : Strike it Rich

Brandon Munro, Managing Director of African Mining Capital, Joint Venture partner of Bannon Limited, tells Africa Outlook more about this emerging mineral resources exploration company with ambitious plans for the future.

Baobab Resources : High Hopes for Tete

Ben James, Managing Director of Baobab Resources, talks about the development of the Tete pig iron project in Mozambique, one of the most exciting development stories in southern Africa.

Namibia Diamond Trading Company : The Pride of Zambia

Africa Outlook profiles Namibian diamond beneficiation company Namibia Diamond Trading Company (NDTC) and talks to Head of Sales and Marketing Brent Eiseb.

Foskor : Driving Operational Excellence

Africa Outlook profiles South African phosphates firm Foskor, one of the world’s largest producers of phosphate and phosphoric acid.

Kudumane Manganese Resources : A New Breed of Mine

Africa Outlook takes a look at the opening up of South Africa’s Kalahari manganese fields and Kudumane Manganese Resources’ R1.5 billion manganese mine.

Exxaro Resources : More Than Black Gold

Exxaro Resources is one of South Africa’s largest diversified resources groups with interests in coal, mineral sands, ferrous and energy markets

Lucara Diamond Corporation : A Diamond in the Rough

Southern Africa-focused gem producer Lucara Diamond Corporation has enjoyed a spectacularly good start to the year, its first special tender of large and exceptional diamonds sold for revenues totalling $24 million.