CEO, Morné du Plessis, tells us why Minergy Coal is pioneering the southern African mining industry, as the company puts Botswanan coal on the industry map.

PIONEERING THE BOTSWANA COAL INDUSTRY

Minergy Coal (Minergy) was first established in 2012, as its initial shareholders registered a prospective mining license in Botswana for thermal coal. Although they were looking for other minerals at the time, coal was by far the most abundant resource with good geological information available. As a result, the shareholders established two drilling programmes to assess the quality of coal in the Mmamabula coalfields.

Working on the founding principle to supply coal for energy generation in Botswana, there was initially no urgent need to support a power source of electricity in the area. However, a review of drilling results demonstrated that the resource could support the sale of sized thermal coal across Botswana, South Africa, Namibia, and other neighbouring countries.

“Subsequently, we listed Minergy in 2017 on the Botswana Stock Exchange,” introduces CEO, Morné du Plessis.

From here, Minergy went from strength to strength, as its listed status and equity funding facilitated a further drilling programme, which kick-started the regulatory process necessary for licensing.

“Once environmental approval was received, a mining license was awarded to us at the end of August 2018 and we immediately started developing what became our Masama Coal Mine. This foresaw the development of box cutting, bush clearing, creating road access, as well as power and water reticulation,” du Plessis recalls.

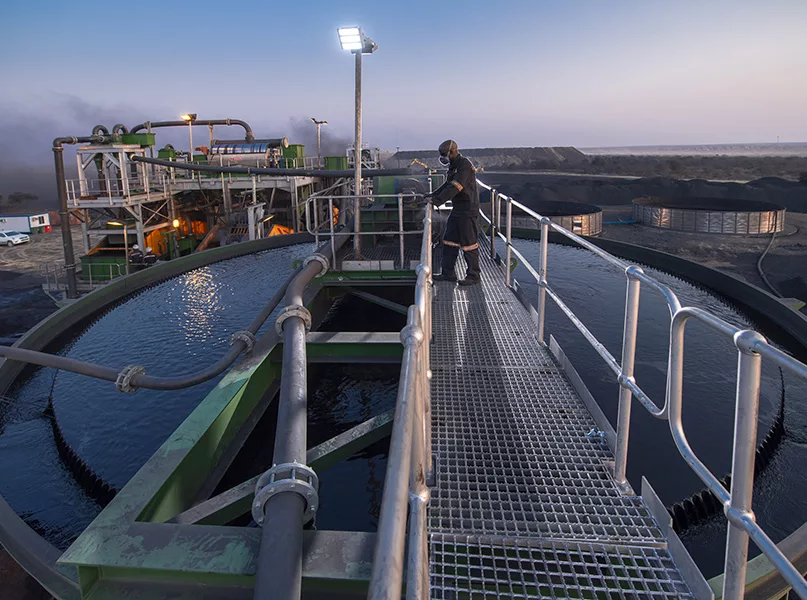

Thus, within 12 months of being awarded the mining license, the Masama Coal Mine was developed, along with the completion of the first stage of a processing plant in 2019, which saw a dense medium separation (DMS) module supported by mobile crushing and screening. This enabled Minergy to start selling its product to the regional market.

How Important Are Supply Chain Operations and Partner Supply Relationships to the Company?

“We currently have three main service providers who are indispensable to the business. We work on a contract model, so we don’t own the equipment ourselves. We are heavily reliant on our opencast mining contractor and processing plant service provider together with fuel supplier.

Morné du Plessis, CEO

A further group of service providers that come into play is transporters. Generally, we sell Free on Truck (FOT) where the customer is responsible for the management and cost of transportation. Where requested to do so, we provide a landed solution to offer transport for certain customer requirements. For this service, we often utilise the local transport industry as we believe it is important to work closely with the local community and ensure we deliver the product effectively to our customers.”

OVERCOMING DISRUPTION

Continuing its development strategy, Minergy signed a three-year offtake agreement with a reputable cement supplier.

“Typically, we would then start ramping up our activities, but unfortunately the COVID-19 pandemic interrupted everybody, and eventually halted our efforts. We couldn’t start operating again until late 2020,” du Plessis tells us.

Once the company recommenced operations, it completed phase two of its processing plant, supplying the front section which crushes the product, so that the process was automated and fed straight into the DMS section built in phase one.

Subsequently, despite the turbulence in the market caused by COVID-19, Minergy completed phase three of the processing plant, a water management system (WMS), that recycles this precious resource in a region where water scarcity remains a significant issue.

Following the construction of the final phase of the plant, a rigid screening section, the Coal Handling and Preparation Plant (CHPP) reached completion in September 2021. Fortunately, it was finished before the start of the Russia-Ukraine conflict. Minergy navigated this period by running the mine at full capacity to make the most of the excess buying that occurred at the time.

Numerically, this equated to 125,000 tonnes of run-of-mine (ROM) feed sent to the processing plant, which resulted in 70,000 tonnes of saleable coal. Minergy was then able to consistently achieve this capacity for the latter half of 2022.

Last year also brought great prosperity in the international market, as Minergy became the first Botswanan company to export coal via sea to Europe. This produced 210,000 tonnes of sales, equating to six vessels in total, as the product was well received globally.

“The end of last year was also the first period in which the company was a profitable operation, achieving an earnings before interest, taxes, depreciation, and amortisation (EBITDA) position,” du Plessis proudly informs us.

PRECISION PRODUCTS

Minergy is continuously bolstered by the intricate quality of its products, as the company produces three different types of coal in various sizes.

“Typically, coal producers talk about seaborne thermal coal exports, which is an unsized product that the international indexes measure. Alternatively, we produce sized thermal coal, ranging from a zero to 50-millimetre (mm) product, which we sell to the regional market,” du Plessis explains.

The first of Minergy’s three products is known as Duff, characterised as a finer product, ranging from zero to 12mm. Duff is widely used in the cement market, as its fine consistency can easily be blown into the kiln, acting as a differentiator in the construction sector.

Secondly, the product produced between 12 and 30mm is called Pea and is used in manufacturing outlets being fed by a boiler application to create steam and other forms of energy for the plant. This process is used across canneries, breweries, fisheries, textile manufacturers, and more.

Finally, the biggest fraction, called Small Nut, sizes between 30 and 50mm. Small Nut can typically be found in specialised heating applications, used in the creation of steel and other metals.

On top of this, Minergy is fortunate enough to have its Masama Coal Mine in a prime location, 80 kilometres (km) northeast of Botswana’s capital city of Gaborone.

“We operate the most southerly located mine in the country, which is important to note because logistics is everything in this game, and the closer you are to your target market and land, the cheaper the product. So, it gives you an advantage in terms of customers and pricing,” du Plessis emphasises.

A POINT TO PROVE

As it expands, Minergy is evolving its industry impact to herald the Botswanan coal industry as a vital part of the international coal network, due to its initial success, prime location, and plentiful resource.

“It’s important to note that timing is everything. With this in mind, we were the first open cast coal mine that operated commercially in Botswana, as many other mining entities remained underground or undeveloped waiting for power solutions,” du Plessis states.

“Generally, people said sized Botswana coal is not of good enough quality to compete commercially. However, we have proven to the world, not just regionally but internationally, that the coal in the Botswanan ground is of such a quality that it competes with the very best supply in the world, especially with low ash and sulphur qualities.”

As noted earlier, the location of the Masama Coal Mine is a key differentiating factor, since it is situated close to the South African border. This is advantageous as it places the mine near to the Northwest Province in close proximity to its main market of the cement industry.

As a result, Minergy is closer than most of its competitors to the target markets and has greater access to its strongest customer base.

Furthermore, Minergy’s sizeable resource also sets the company apart; whilst the majority of the Southern African mining market struggles to obtain a large resource, Minergy has an impressive 380 million tonnes on its mining license, 80 million of which is open and castable, providing a reliable level of longevity and stability to its products.

Alongside its optimum location, Minergy also bears the advantage of being supported by the Botswanan government since its establishment.

“The narrative around coal has been unfairly negative across the world in recent years, but with governmental support, we’re in a stable and investment-friendly region.”

“We have proven to the world, not just regionally but internationally, that the coal in the Botswanan ground is of such a quality that it competes with the very best mining entities in the world”

Morné du Plessis, CEO, Minergy Coal

MINERGY CARES – CSR IMPACTS

- Connected the local area with electricity in 2019, five years before it was originally scheduled by the local government.

- Supported the creation of local businesses, including the development of local spaza and food stalls.

- Building of rental houses for workers by locals.

- The first large supermarket and extensive supply outlets established.

- Providing computers to local schools and offices.

INCREASING TARGETS TWOFOLD

As Minergy navigates the coming years, it has tenacious plans to double its capacity.

“To add to this, at a lower capital expenditure (CapEx), we could double the capacity of our Masama Coal Mine. As such, we could produce 250,000 tonnes of ROM feed, which can generate 150,000 tonnes of saleable coal per month,” du Plessis highlights. This includes the development of significant metallurgical deposits that form part of the resource.

However, for the company to achieve the goal of double capacity, it must first address the limited level of infrastructure across the local community and the Masama Coal Mine.

Firstly, the current gravel track that leads to the mine has limitations and challenges. To tackle this, Minergy is working with the government in a private-public partnership (PPP). This dictates that the government and the company will split the expenditure for tarring the road, to guarantee a high-quality route that stretches 23km from the mine to the local town. Furthermore, the investment in the road will help solve issues of dust caused by gravel, as well as creating a smoother traffic flow.

“We are very grateful that the government has agreed to the PPP. We have already started with the design, so we are hoping to have the new road completed by the end of next year,” comments du Plessis.

In addition to transport infrastructure, Minergy is also responding to the limited surface water resources available in the country. Since Minergy requires greater accessibility to water to double its capacity and help the community, the company has engaged with local water utilities and the government department to combat the issue.

Alongside its WMS, Minergy has subsequently been given access to a strong feed of water, known as the North-South Carrier, which links to the processing plant. However, this will take great precision and planning, as the water supply is approximately 43km from the plant, but Minergy is more than ready to take on the challenge.

Alongside plans for doubling its capacity, Minergy strives for a diversification of its portfolio, as the organisation aims to be part of supplying coal to a locally established power plant in the region.

“I think we have the capabilities to do this as we have enough coal to support the respective power plant for another 30 years without a problem,” emphasises du Plessis, who strives to see the company have a second listing on an international stock exchange, particularly the London market, as Minergy endeavours to elevate its international mining trade.