Issue 42

Medtech Angola : Evolving with the Pace of Change

Medtech Angola has adopted a continuous improvement strategy that combines international best practices with the national resources required to prosper in an ever-changing market.

Capespan South Africa Pty Ltd : A Fresh Fruit Focus

Delivering exceptional fruit straight from the orchard and right on to the shelves of the world’s retail, wholesale and food service partners, the Outspan, Cape and Goldland brands by Capespan South Africa are synonymous with quality.

GOGO Fruit | EKM Exports : The Quest for Fruit Excellence

Guided by the ultimate objective to vertically integrate its supply chain, GOGO Fruit is on a mission to provide the best service to both local growers and buyers in all corners of the world.

Denau : Focused & Fresh

The production and export of both grapes and citrus products has distinguished South African-based company, Denau within a competitive market over the decades, and it is now looking towards conservative profits to ensure long-term success.

KCB Group Limited : Going Digital

KCB Group Limited is moving away from the traditional banking formula in a bid to engage with the region’s youthful population and bring simple mobile banking and financial inclusion services to the customer’s fingertips.

African Trade Insurance Agency : Taking the Risk Out of Africa

African Trade Insurance Agency (ATI)’s 15 years of prominence has taken on extra importance in recent years following a revised membership strategy; a tact which is set to succeed by virtue of its on-the-ground presence across each operating nation.

Universal Corporation Ltd : Improving the Quality of Human Life

Universal Corporation Ltd (UCL) is playing a vital role in Africa in reducing the continent’s reliance on imports in the healthcare sector; subsequently helping to create an environment of self-sufficiency across central and eastern regions in particular.

Suzuki Auto South Africa : A Suzuki Way of Life

Suzuki Auto South Africa (SASA) is keeping a close eye on the everyday needs of consumers in order to maintain a competitive value proposition that takes care of motor vehicles over their entire lifecycle.

Fuchs Lubricants South Africa : Lubricants, Technology, People

FUCHS Lubricants South Africa brings German manufacturing expertise to a highly lucrative regional market, and is looking to further compound its ongoing prominence on the continent.

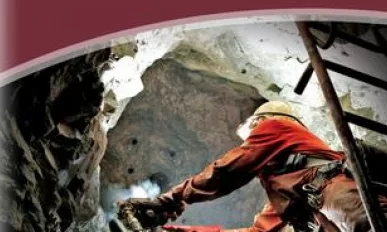

African Underground Mining Services : A Model of Excellence

African Underground Mining Services (AUMS) is celebrating almost 10 years in Africa via a series of ongoing, forthcoming and prospective projects.

Namcor : Creating Value through Strategic Investment

By adopting a strategy of consolidation to foster a stricter focus on financial performance and Namibia’s energy needs, NAMCOR is hoping to create value through the discharge of its mandate as the national oil company.

Zuva Petroleum : Energy Every Day

More than 80 years of tradition and lineage has transcended into a more recent six years of industry dominance in Zimbabwe, as Zuva Petroleum looks to capitalise on its position as one of the continent’s leading integrated energy companies.